Kroll: Risk in a world of constant crises

Over the past few years, it seems like the world has gone from one crisis to the next. From the radical increase in natural disasters to the ongoing COVID-19 pandemic and war between Russia and Ukraine, there has never been a more important—although difficult—time for companies to ensure that business risks are effectively managed and adequate insurance policies are in place.

For appropriate insurance policies to be in place, businesses need to know exactly what is at risk and the potential loss that may result if that risk materializes. For example, a company with a manufacturing facility needs to know what it would cost to replace that facility if it burned down tomorrow, or how much more it might cost to replace that same facility a year from now. Having an accurate and up-to-date replacement value that all parties trust is key to assuring 1) that the company has adequate coverage to rebuild after a loss, 2) that the company is not paying excessive premiums. However, therein lies the tricky part: in today’s uncertain environment, determining the appropriate insurable value for tangible fixed assets can feel like trying to hit a moving target.

Impact on Valuations

As valuation specialists, we are constantly asked by our clients how a particular event will impact their current sums insured. Over the last 28 months, the global economy witnessed drastic changes. For a period, there was minimal production, which led to an increased backlog of orders for goods and services. This had a long-lasting impact on the overall supply chain of goods, particularly given the long-term need for qualified workers. Following the shutdowns, we have seen an increase in demand, especially due to the significant backlogs. More recently, we have also observed larger-than-normal inflation, rising energy costs and numerous other factors impacting the economy. All these pressures have led to significant increases in construction costs and volatility when compared to increases in recent years.

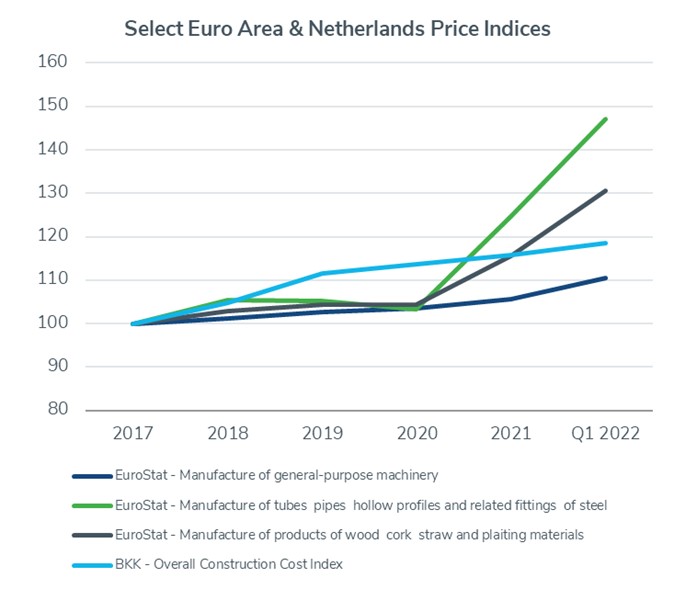

These various influences are heavily impacting both materials and labor. Two of the major local construction cost index sources we monitor are EuroStat, a collection of local statistical information aggregated by the European Commission, and BouwkostenKompas (BKK), a local Dutch construction cost index. It is important to note that, because of the lagging nature of indices—they represent actual costs at a point in time versus projections of costs—they are always based on data from trailing months.

When we look at the various indices over the past five to six years and focus on the impact of the events of the past 28 months, we see that the average impact on building construction costs and general-purpose machinery is relatively minor at around 2-5% per year, when compared to the changes in the cost of steel and wood, where we observe double-digit increases for consecutive years. When budgeting a new construction project, it is important to remember that the raw materials are often the largest driver of the overall price.

The State of Trust

Now more than ever, accurate replacement values are required for businesses to navigate these treacherous waters. Regular and frequent review of insurable values have become a necessity. To serve our clients in the best possible way and meet market demands, we have focused our resources on identifying the issues at hand and coming up with future-proof solutions to those problems. We have developed new services, such as portfolio reviews, risk heat mapping, and the ability to carry out virtual site inspections. We have also developed interactive dashboards where stakeholders can access critical data to ensure compliance with regulations, accurate pricing and alignment with industry best practices.

With the ever-evolving risk and insurance landscape, the one thing that remains constant is trust. Trust in the relationships we build, trust in the values we provide and trust that we have our clients’ best interests at heart. That’s why, as we navigate uncertainty, the core of all the services we offer is transparency, data, technology and insights for risk, governance and growth flexibility.

This article was written by Matthew Donahue and Shreyasi Hait

Author bio

Matthew Donahue is a director in the Amsterdam office, where he leads the Fixed Asset Advisory Services team within the Valuation Advisory Services practice. Matthew has over 10 years of experience valuing real and personal property for insurance appraisals, financial and tax reporting, bank financing, and other purposes for various types of businesses.

Shreyasi Hait is a senior associate in the Fixed Asset Advisory Services practice, based in Amsterdam. Shreyasi has a background in chemical engineering and leverages over four years of experience valuing real and personal property for insurance appraisals, financial and tax reporting, bank financing, and other purposes for various types of businesses.